Aoteng Insights

Your go-to source for the latest trends and insights.

Riding the Wave: Catching CS2 Trading Reversals Just Right

Master the art of CS2 trading with our expert tips on catching reversals. Ride the wave to profits before it’s too late!

Top Strategies for Identifying Trading Reversals in CS2

Identifying trading reversals in CS2 can significantly enhance your trading strategy and profitability. One effective method is to monitor key support and resistance levels. These levels are often where price action tends to reverse, creating potential entry and exit points. You should also pay attention to volume trends; a sharp increase in volume at these levels can signal a strong reversal, indicating that the market sentiment is shifting. Utilize technical indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm potential reversals, as they can provide additional insights into overbought or oversold conditions.

Another key strategy is to leverage candlestick patterns for identifying potential reversals in CS2. Patterns like bullish or bearish engulfing and hammer or shooting star formations can help traders spot potential turning points in the market. It's crucial to consider the overall market trend and the context in which these patterns appear. Combining candlestick analysis with other indicators such as Fibonacci retracement levels can further refine your reversal trading strategy. Remember, successful trading in CS2 requires not just the identification of reversal signals but also a well-defined risk management plan to protect your capital.

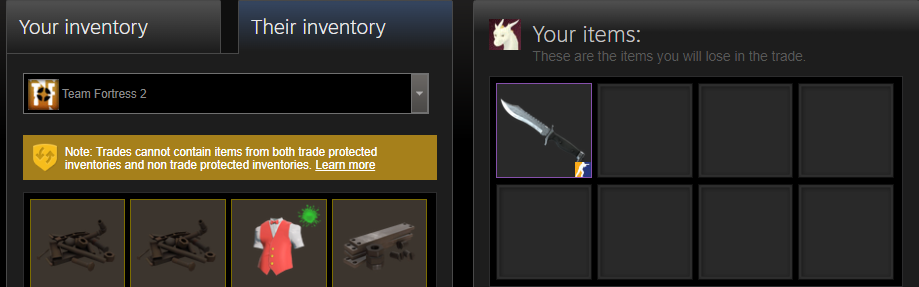

Counter-Strike is a popular first-person shooter game series that emphasizes team-based tactics and competitive gameplay. Players can engage in various game modes, including bomb defusal and hostage rescue, making each match a test of strategy and skill. For those looking to improve their in-game trading strategies, the trade reversal guide can provide valuable insights.

What are the Key Indicators for Catching CS2 Trading Waves?

When it comes to catching CS2 trading waves, understanding the key indicators is paramount for success. One of the primary indicators is the market sentiment, which can be gauged through various social media platforms and community forums. Monitoring trends in player activity and popular trades can provide valuable insight into whether the market is bullish or bearish. Additionally, tracking the price history of items over time can reveal patterns that traders can exploit for profitable trades. For instance, a sudden spike in the price of a popular skin often precedes a wave of trading activity.

Another crucial factor is the trading volume. High volume often correlates with more significant price movements, making it easier to identify potential waves in trading. Utilizing tools like price alerts and trade analyzers can help traders stay ahead of the curve. Technical analysis methods, such as moving averages and RSI (Relative Strength Index), can also be instrumental in predicting market shifts. By combining these indicators, traders can enhance their chances of catching profitable CS2 trading waves and optimizing their trading strategies.

How to Adapt Your Trading Style for Success in CS2's Volatile Market

Adapting your trading style in CS2's volatile market requires a keen understanding of the dynamics that drive price fluctuations and player behavior. Start by assessing your current trading strategies and identify areas for improvement. Consider using a trend-following approach to capture upward movements while employing a stop-loss strategy to minimize potential losses. Keeping an eye on market indicators, such as player statistics and in-game events, can also help you make informed decisions, ensuring that your strategy aligns with the increasing volatility.

Moreover, being flexible is crucial in a constantly changing environment. Implementing a diversified trading portfolio can help mitigate risks associated with individual trades. This could involve trading different items or adjusting your focus based on current trends and market sentiment. Regularly revisiting and adjusting your approach will be key to thriving in CS2's volatile market. Stay active in forums and communities to gather insights, and never hesitate to tweak your style based on new information and market shifts.