Aoteng Insights

Your go-to source for the latest trends and insights.

Marketplace Liquidity Models Unleashed: Navigating the Waters of Fluid Trading

Dive into the world of marketplace liquidity models! Discover how to navigate fluid trading for maximum gains and smarter decisions.

Understanding the Basics of Marketplace Liquidity Models

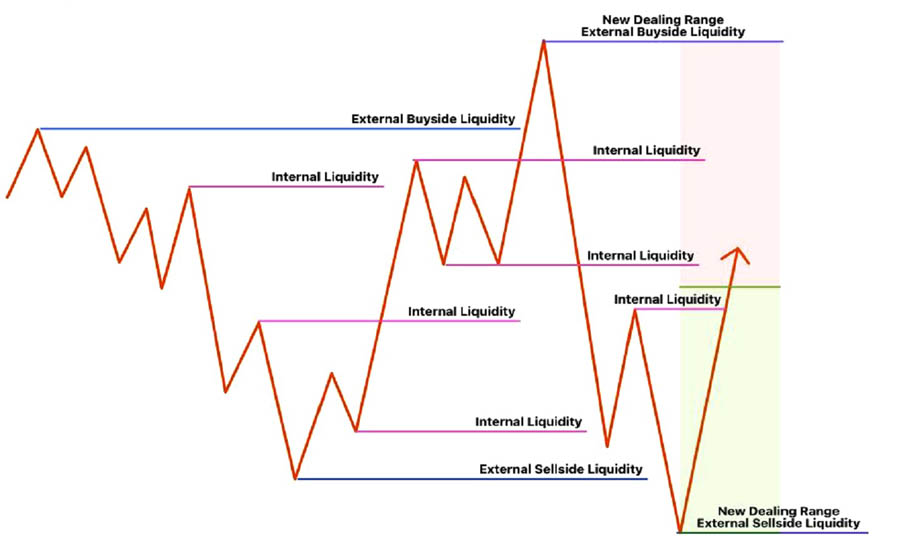

Marketplace liquidity models are essential for understanding how assets are bought and sold within a market. Liquidity refers to the ease with which assets can be converted into cash or liquidated without impacting their price significantly. A high liquidity model ensures that there are enough buyers and sellers in the marketplace, facilitating smooth transactions. In essence, there are two main types of liquidity models: order book and automated market makers (AMM). Each model has its own strengths and weaknesses, influencing how traders and investors engage with the marketplace.

To further grasp the implications of these models, consider the following factors that characterize marketplace liquidity:

- Market Depth: This indicates the market's ability to withstand large orders without unveiling drastic price changes.

- Spread: The difference between the buy and sell prices reflects the liquidity level; tighter spreads often indicate higher liquidity.

- Transaction Volume: Higher volumes typically suggest a more liquid market.

Understanding these fundamentals is crucial for anyone looking to navigate the complex world of marketplace liquidity effectively.

Counter-Strike is a popular tactical first-person shooter that has dominated the esports landscape for years. Players form teams to engage in objective-based gameplay, utilizing strategy and teamwork to secure victory. For those looking to enhance their gaming experience, they can use a daddyskins promo code to unlock special skins and items.

How to Optimize Your Trading Strategy with Liquidity Insights

Optimizing your trading strategy requires a keen understanding of market liquidity, as it plays a crucial role in determining the effectiveness of your trades. By analyzing liquidity metrics, such as bid-ask spreads and trading volume, traders can gain valuable insights into how easily they can enter and exit positions. To begin, consider the following steps to incorporate liquidity insights into your strategy:

- Monitor liquidity levels: Keep an eye on both historical and current liquidity levels for your chosen assets.

- Adjust your entry and exit points: Use liquidity data to refine your trading points, aiming for times with higher liquidity to minimize slippage.

- Diversify your portfolio: Invest in multiple assets to spread your risk and take advantage of different liquidity profiles.

Furthermore, understanding market participants can enhance your strategy. Market makers, institutional traders, and retail investors all contribute to liquidity, and their actions can create significant price movements. For example, during periods of low liquidity, a large order from an institutional trader can cause dramatic price shifts, which may adversely affect retail traders. Therefore, staying informed about market sentiment and participants can lead to more liquidity-aware trading decisions. By embracing a comprehensive approach to liquidity, you'll be better equipped to optimize your trading strategy and improve your overall performance.

What Factors Impact Marketplace Liquidity and How to Navigate Them?

Marketplace liquidity is influenced by several key factors that determine how easily assets can be bought or sold without causing significant price fluctuations. Demand and supply are primary drivers; a higher demand for an asset relative to its supply can lead to increased liquidity. Additionally, market participation plays a crucial role; more participants generally enhance liquidity since a larger pool of buyers and sellers facilitates smoother transactions. Factors such as trading volume, transaction costs, and market transparency also significantly impact liquidity. Understanding these elements is essential for investors looking to optimize their trading strategies.

To effectively navigate the complexities of marketplace liquidity, investors should adopt several strategies. Firstly, they should analyze market trends and use tools that provide insights into the current liquidity status, such as order books and trading indicators. Secondly, being aware of the timeframe for transactions can greatly affect outcomes; longer-term strategies may mitigate liquidity risks compared to quick trades. Lastly, diversifying investments across various assets can spread risk and increase potential liquidity by tapping into different marketplaces. By being proactive and informed, investors can successfully manage the factors impacting liquidity.