Aoteng Insights

Your go-to source for the latest trends and insights.

Drive Smart: Sneaky Ways to Slash Your Auto Insurance Costs

Unlock hidden savings! Discover clever tips to cut your auto insurance costs and keep more money in your pocket. Drive smart, save big!

10 Tips to Lower Your Auto Insurance Premiums Today

Lowering your auto insurance premiums can be simpler than you think. Start by shopping around and comparing quotes from different insurance providers. Each company has its own unique pricing model, so obtaining multiple quotes can help you identify the most competitive rates. Additionally, consider bundling your auto insurance with other policies, such as home or renters insurance, as many providers offer significant discounts for bundling. Understanding your coverage needs is crucial; make sure you are not overpaying for coverage you don't require.

Another effective way to lower your auto insurance premiums is by increasing your deductible. By opting for a higher deductible, you are essentially agreeing to pay more out of pocket in the event of a claim, which can result in lower monthly payments. Additionally, maintain a clean driving record—accidents and violations can significantly impact your premium rates. Taking a defensive driving course can also reduce your premiums, as many insurers offer discounts for completed courses. Lastly, regularly review your policy and adjust it based on changes in your driving habits or vehicle usage.

How Your Driving Habits Can Impact Your Insurance Rates

Your driving habits play a crucial role in determining your auto insurance rates. Insurance companies assess the risk of insuring a driver based on various factors, including driving behavior. For instance, speeding, sudden stops, and frequent hard braking can signify aggressive driving and increase the likelihood of accidents. These behaviors can lead to higher premiums as insurers categorize you as a higher-risk driver. Moreover, maintaining a clean driving record, free from accidents and traffic violations, can help you secure lower rates over time.

In addition to your driving behavior, the frequency and type of driving you do can also impact your insurance costs. Long commutes or using your vehicle for commercial purposes may result in increased premiums, as these situations expose you to a greater potential for accidents. Conversely, driving less and opting for safer driving practices, such as following speed limits and avoiding distractions, can not only enhance your safety but also help keep your insurance rates in check. Consider evaluating your driving habits regularly; small adjustments can lead to significant savings on your insurance premiums.

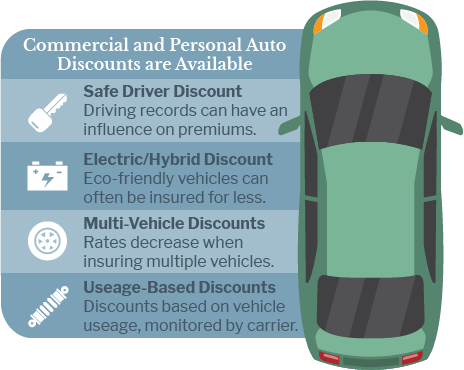

Are You Missing These Discounts on Your Auto Insurance?

Many drivers overlook essential discounts available for their auto insurance policies, which can lead to paying higher premiums than necessary. Are you missing these discounts on your auto insurance? From safe driver incentives to multi-policy savings, numerous opportunities can significantly lower your costs. For instance, if you maintain a clean driving record, you may qualify for a safe driver discount. Additionally, bundling your auto insurance with other policies like home or renters insurance can result in substantial savings. It's crucial to regularly review your policy and discuss with your insurance agent to ensure you're taking advantage of every possible discount.

Another often-neglected area is the use of technology in securing discounts. Many insurance companies offer usage-based insurance, which rewards drivers for safe driving behavior captured through mobile apps or devices installed in their vehicles. Furthermore, factors such as good grades for student drivers or membership in certain professional organizations might also yield additional savings. Reviewing your eligibility for these discounts not only helps in reducing your monthly payments but also encourages safer driving habits. Don't wait any longer—check with your insurer today to discover if you're missing out on these savings!